Dorschden Swing Volatility Solver

The Dorschden Swing Volatility solver calculates the distance between swing points (the distance from swing top price to swing bottom price) as a way to measure volatility. Swing point prices are derived from the SiSwings Indicator, included with BloodHound.

BloodHound v2

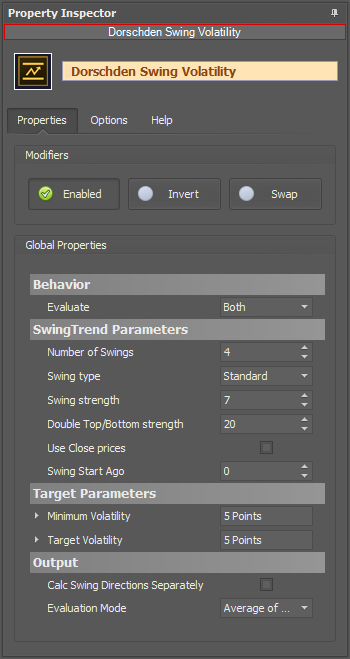

Properties tab

This section provides quick access to commonly used output modifiers.

Please note: The buttons only modify the individual instance of the selected node(s) on a Logic Board. Thus, the buttons are only visible when a node is selected on the Logic Board. The buttons are not available when a solver is selected in the Solvers panel, because the original solver's output can not be globally modified.

This behavior is consistent with adding a function node afterwards, so that the original solver's output remains unmodified elsewhere in the system. It is similar to having an SMA(50) on several charts. Changing the plot color on one chart does not modify the plot color on the other charts.

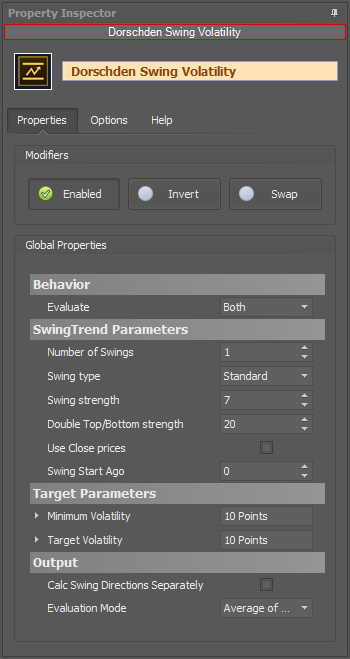

Global Properties

Global Properties

Behavior

SwingTrend Parameters

Target Parameters

Output

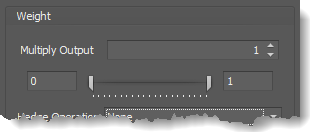

Options tab

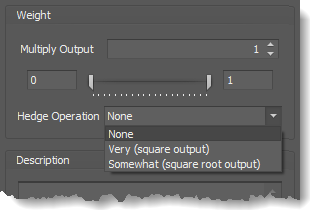

This section is used to modify the node's final output value. It is only useful for designing fuzzy logic systems, or a fuzzy logic section of a system.

Please note: The Weight controls only modify the individual instance of the selected node(s) on a Logic Board. Thus, the Weight controls are only visible when a node is selected on the Logic Board. The controls are not available when a solver is selected in the Solvers panel, because the original solver's output can not be globally modified.

This behavior is different than BloodHound 1.0. In BH 1.0, the Weight controls modified the nodes output globally (every instance). This change in BH 2.0 adds more system design granularity.

Multiply Output: This takes the internal values (the Long and Short values determined via the Properties tab » Output Rules section) and multiplies them by this value.

Multiply Output: This takes the internal values (the Long and Short values determined via the Properties tab » Output Rules section) and multiplies them by this value.

Note: The final output will not exceed a value of 1, as described in the Slider control below.

Slider control: The slider constrains the final output to a value of 0 to 1. The left side of the slider sets a minimum value that is output regardless if the solver condition is true or not. The right side sets a maximum value that is output. The output is capped.

e.g. Three indicator conditions are being checked, and thus three solvers are created. Only two out of the three indicator conditions are needed. An Additive logic node is used to add the solver's outputs together. Just two out of the three solvers need to add up to a value of 1. Therefore, the right slider (max output value) for all three solvers is set to 0.5. When two indicator/solver conditions are found, thus the outputs = 0.5, then the calculation, in the Additive node, is 0.5 + 0.5 + 0 = 1. A value of 1 means the two out of three condition is true.

Hedge Operation: This applies a mathematical formula to the internal value.

Hedge Operation: This applies a mathematical formula to the internal value.

None: No modification is applied.

Very (square output): A squaring formula is applied. Output = value^² .

Somewhat (square root output): A square root formula is applied. Output = √value .

Description

Description

This text area provides a place to write a full description of what the node is doing, used for, or what ever you want.

Note: The Description is global to all instances of the node. It is not applied individually to each instance as the Weight controls are.

Help tab

This tab displays the documentation page (from this web site) of the selected node.

Please note: NinjaTrader v8.0.26.0 or newer is required for the built in web viewer to work, and thus the documentation to be displayed.

Video Tutorial

This video is from our weekly Workshop titled Solvers 12-13, on Sep 26th, 2012.

For more benefit please watch in full screen mode, as this video is recorded in HD.

This video shows BloodHound v1, however the settings and usage are the same.

Examples

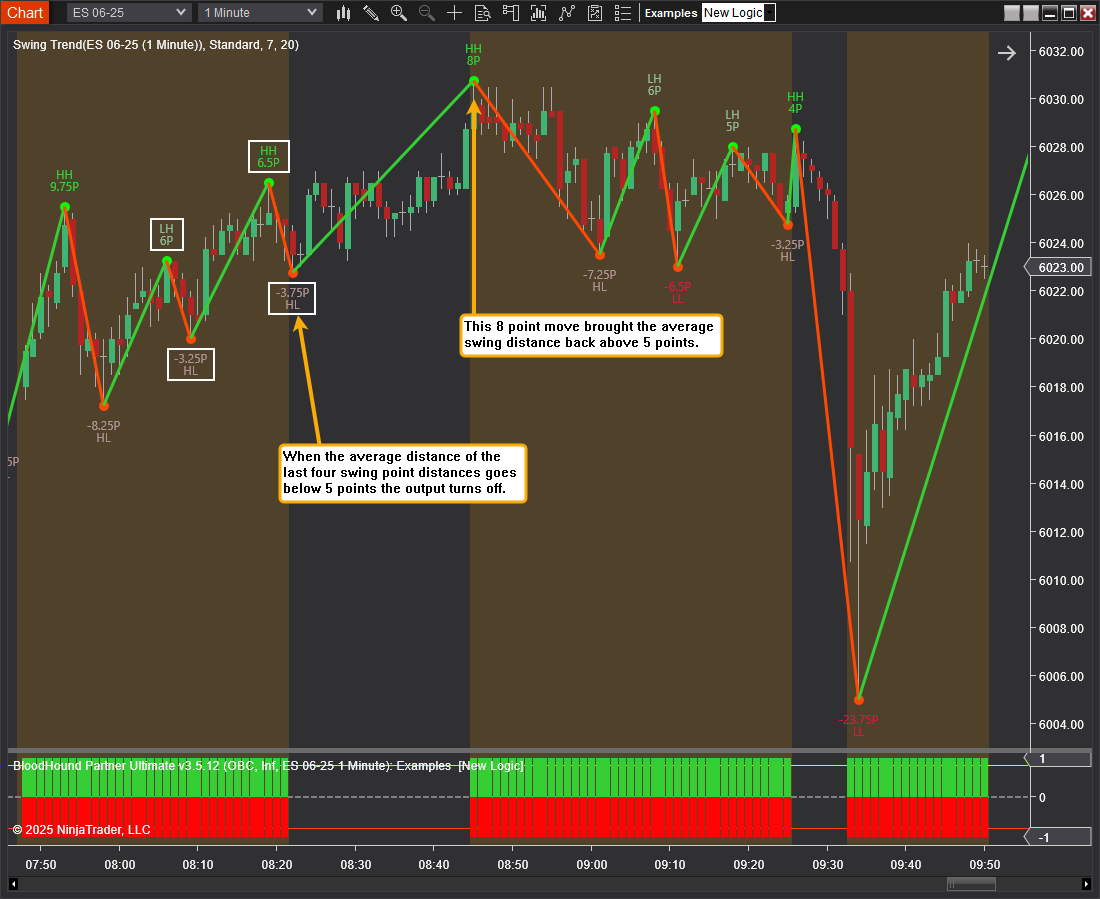

Example 1A: The Basics

This demonstrates the basic function of the Dorschden Swing Volatility solver. The Solver tracks the distance price moves from swing point to swing point, and then determine if there has been enough price movement/volatility to trade. It can be used to detect range bound/choppy market action.

- Add the Dorschden Swing Volatility solver to the Logic Board, and connect to the Result node

- Set Number of Swings to 1

- Set Minimum Volatility to 5 Points

- Set Target Volatility to 5 Points

When the swing length is greater than 5 points an output occurs. Note the solver outputs a long & short at the same time, because volatility has no trend direction.

Example 1B: The Basics

This demonstrates the basic function of the Dorschden Swing Volatility solver. This time the 'Number of Swings' will be left at 4, which averages the last four swing length together. The average length must be equal or greater than 5 Points for an output to occur.

- Add the Dorschden Swing Volatility solver to the Logic Board, and connect to the Result node

- Leave the Number of Swings unchanged at 4

- Set Minimum Volatility to 5 Points

- Set Target Volatility to 5 Points

BloodHound v1

Dorschden Swing Volatility Solver

Parameters

Output

Swing Parameters

Targets

Video Tutorial

This video is from our weekly Workshop titled Solvers 12-13, on Sep 26th, 2012.

For more benefit please watch in full screen mode, as this video is recorded in HD.

Examples

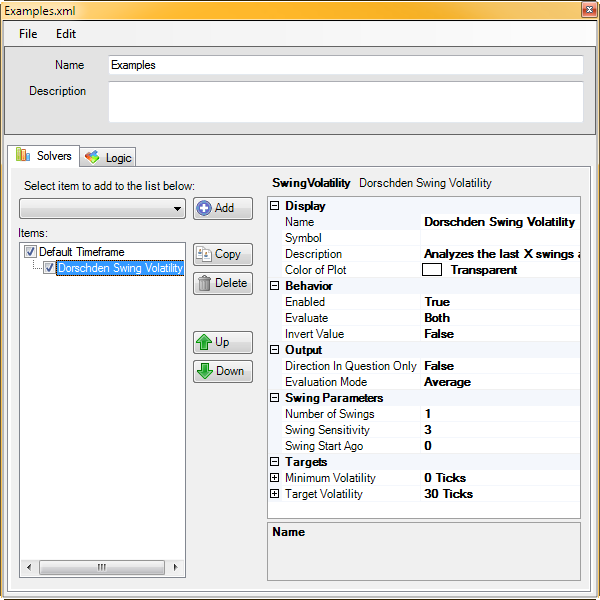

Example 1A: The Basics

This demonstrates the basic function of the Dorschden Swing Volatility solver. This Solver measures the length price moves from swing point to swing point to determine if there is enough price movement to trade with. It can be used to detect range bound choppy market action.

- Add the Dorschden Swing Volatility solver

- Set Number of Swings to 1

- Set Target Volatility to 30 Ticks

Note in these charts that the Long & Short Threshold in the Signal Properties are set to 0.99. When price moves more than 30 ticks from the previous swing point an output of 1 is given.

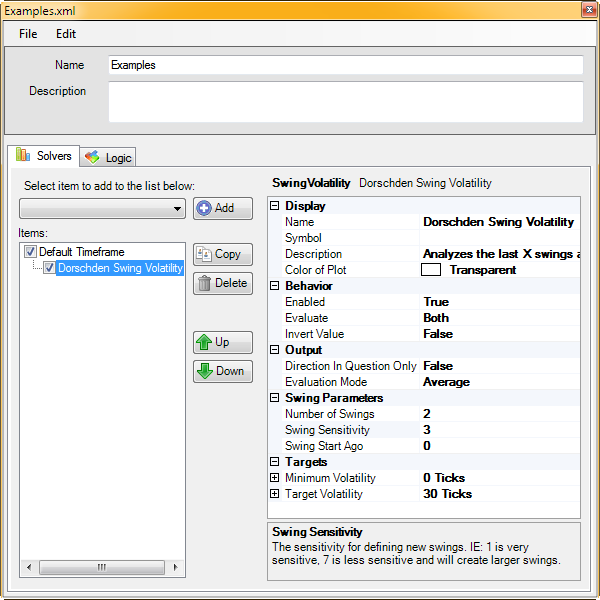

Example 1B: The Basics

This demonstrates the basic function of the Dorschden Swing Volatility solver. This time the Solver will be set to average 2 trend length together. The average length must be equal or greater than 30 ticks for an output of 1 to occur.

- Add the Dorschden Swing Volatility solver

- Set Number of Swings to 2

- Set Target Volatility to 30 Ticks

Note, in these charts the Long & Short Threshold parameters (under Signals) are set to 0.99. When 2 trend lengths average more than 30 ticks an output of 1 is given. For example:

- Swing A(15ticks) + swing B(35ticks) = 50 / 2 = 25 ticks average therefore no signal (BH output is less than 1).

- Swing B + C = 61 / 2 = 30.5 ticks average for an output of 1. Swing D + E = 60 / 2 = 30 ticks average for an output of 1.